-

Net PPM

Back to Glossary

Net PPM

What is Net PPM?

Net PPM is a key financial indicator Amazon uses to measure the true profitability of a product sold via the Vendor Central (1P) model. Unlike gross margin, Net PPM accounts for vendor contributions, such as accruals, contra-COGS, and trade terms - offering a more realistic view of Amazon’s actual margin.

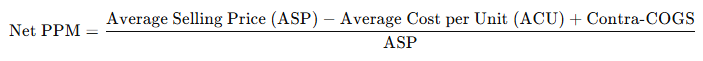

Formula: Where:

Where:

- ASP = Average Selling Price

- ACU = Average Cost per Unit (what Amazon pays the vendor)

- Contra-COGS = Vendor-funded contributions that offset Amazon’s cost (e.g. marketing funds, co-op, MDF, freight allowances)

Why Net PPM matters:

- Amazon uses it to assess the financial health of each ASIN

- Low Net PPM can result in CRaP status (Cannot Realize any Profit)

- Influences reordering decisions, PO volume, and negotiation leverage

- Critical metric during Annual Vendor Negotiations (AVN)

- Helps vendors justify or renegotiate terms (e.g., discounts, freight, AVS fees)

💡 Example: A vendor selling a kitchen appliance at $50 ASP, with a $40 ACU and $5 in Contra-COGS, would have a Net PPM of (50 - 40 + 5) ÷ 50 = 30%.

In short:

Net PPM (Net Pure Product Margin) shows Amazon’s true margin on a vendor product after subtracting cost and adding back vendor contributions - making it one of the most important profitability metrics for 1P vendors.

Ready to Put Your Knowledge to Use?

Now that you understand the terminology, start using SoldScope to research products, analyze keywords, and grow your Amazon business.

Try for Free